In past January Insights, we typically discussed goal-planning for the upcoming year. We’ve talked about how the current market may impact the course of your planning. We’ve discussed strategies for sticking to a money-based New Years Resolution and summarized approaching government changes that may impact your money in the next 12-months.

This January, we will continue to comment on the current state of the economy, but in a slightly different context, as it relates to your money. For 2019, we’re going to talk about three recipes for you to make lemonade out of lemons. In other words, the following three strategies will help you create something positive for your portfolio in the long run, when the current state of the economy tastes rather sour.

1) Warehouse Enough Cash

An emergency fund is important for everyone, regardless of age, living expenses, or net worth. Avoiding an emergency fund that is overfilled is equally important for everyone, because too much cash can be too much of a good thing. Instead, during times when the market is turbulent, think seriously about what your cash-needs might be for the next 12-24 months. If at any point, it seems like you may need to use any portion of your portfolio that is invested in the market to meet those needs, you need to make more cash available.

Cash needs to be available, because except for a few circumstances, we almost always want to avoid selling into a down market. When you are able to sit back and let your market-based portfolio ebb and flow as it was designed to do, you can avoid turning temporary declines into permanent losses to help pay for regular expenses. By keeping enough cash available to meet your needs until the market turns around, you’re insulating yourself from corrections in the market, without compromising your daily quality of life. So, when a bad day, week, or month in the market doesn’t affect you on a day-to-day basis, life begins to taste pretty sweet again.

2) Buy into The Market

Buy on sale. We purchase with this mentality in almost every aspect of our lives, but seem to forget it when it comes to our portfolios. We avoid buying into the market when it’s on sale however, because we’ve been conditioned to feel that a market on sale is a market in turmoil. When the market is strong, it feels like the good days will never end, but when the market is correcting itself, the despair can feel burdensome, at best. Except, history and data both speak to the contrary.

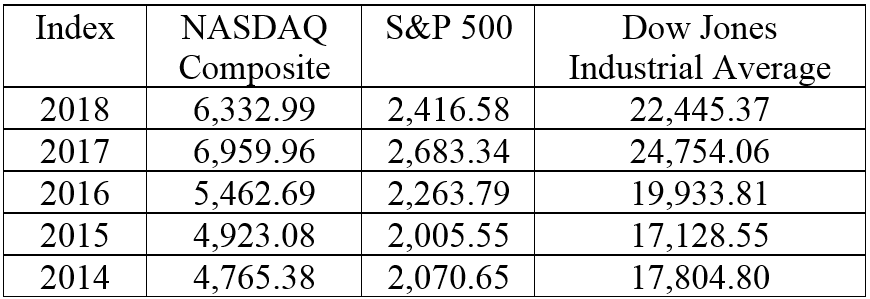

If you look at the value of any given index on the same trading day, year over year, you will likely see an interesting pattern. Most years, the value on that day is higher than it was on that same day, the previous year. (example below) This usually holds true for between two and five consecutive years, until there’s one year when the index’s value is below what it was the year before. 2018 was likely ‘that one year’, signaling a time when the market is “on sale”. Therefore, in a portfolio that is designed to meet the market, you can capitalize on a down-market, by buying into the market.

Respective index’s value on the second-to-last Friday of each year

3) Do a Roth Conversion

The process of a Roth IRA conversion involves recognizing all, or a portion, of a traditional IRA as ordinary income. For example, if you converted an entire Traditional IRA valued at $50,000 last year and your earned income was $100,000, then your total reportable income for 2018 was $150,000. Though, if you initiated this conversion in 2017, when your Traditional IRA was hypothetically valued at $60,000 at the time of the conversion and your earned income was $100,000, then your reportable income would be $160,000. Therefore, it is more economical to do a Roth conversion when the value of a Traditional IRA has temporarily declined, because it will mean a less expensive means to the same end.

Since you’re simply paying tax on a Traditional IRA in a Roth conversion, without making any changes to the account’s underlying investments, the tax consequences are the primary consideration. So, it is important to remember that increasing your ordinary income could bump you into a higher tax bracket and result in a larger tax bill. And while the market may warrant a conversion and all-time high standard deductions may offset the tax consequences, it is important to work together and alongside your tax professional to avoid any surprises.

If you’re invested in the market, you probably want it to be at its highest value, all the time; that’s human nature. However, we all know the market will never be so obedient and that disobedience is what ultimately catalyzes portfolio growth for you, the investor. Though, that disobedience also doesn’t have to spell despair until your portfolio’s balance rebounds. Instead, if you allow yourself to welcome opportunities to turn lemons into lemonade, we’re confident you will savor the fruits of your decisions for years to come.